Written by Marijn Overvest | Reviewed by Sjoerd Goedhart | Fact Checked by Ruud Emonds | Our editorial policy

Supply Chain Statistics — 70 Key Figures of 2024

Key take-aways

- Companies providing AI and automation solutions for supply chain management will likely see significant growth soon.

- Products designed to defend against cyber-attacks will likely be adopted by organizations to secure their supply chains.

- The ongoing digitization of supply chains enhances visibility and transparency resulting in organizations gaining insights into all aspects of their supply chains.

Just like procurement analytics, supply chain statistics can be a long and dragging subject. However, it is an important factor for the success of your procurement process. It’s only right to talk about it with this article.

We will discuss further the importance of supply chain statistics for procurement managers all over the world. We’ll also include 70 key figures for supply chain managers to look at for this year 2024.

When you’re done reading about this article, you should already be an expert in supply chain statistics.

The 70 Key Supply Chain Statistics for 2024

Here are some significant key figures you may want to know for 2024.

1. 83% of Businesses Prioritize Customer Experience Enhancement in Digital Business Strategy for Supply Chains

In this fast-evolving virtual world, a seamless, personalized, and efficient customer experience has become a competitive advantage that can significantly impact customer satisfaction and retention, loyalty, and business success.

According to Gartner, a leading research and advisory firm about 83% of businesses are increasingly recognizing the critical role of the supply chain in enhancing the customer experience and are now prioritizing customer experience within their digital business strategies.

This shift shows that supply chains are no longer just logistical operations but an integral in delivering seamless, customer-focused experiences.

2. Only 6% of Businesses Achieved Full Supply Chain Visibility

The GEODIS Supply Chain Worldwide Survey uncovered that only 6% of the 623 companies surveyed claimed to have achieved full supply chain visibility, despite being the third most important priority in 2017. This low visibility is alarming, given the increasing demand for product availability and corporate transparency from consumers.

Supply chain priorities ranked as on-time, in-full deliveries, and product availability. To address visibility challenges, many startups are developing innovative technologies like blockchain and AI. However, accurate visibility depends on effective communication between supply chain partners.

3. AI’s $5 Trillion Economic Impact by 2025

AI has been growing significance in shaping the future of the global economy. Companies are continuously adapting and harnessing this transformative technology to stay ahead in the rapidly evolving industry.

According to Gartner’s prediction, it suggests that in the year 2025, AI technologies will contribute a staggering $5 trillion in economic value to various industries and sectors around the world. This anticipated trillion economic value generated by AI is expected to result from multiple applications across diverse domains from optimizing supply chain operations and enhancing customer experiences to boosting healthcare outcomes and driving innovation in manufacturing. AI is set to revolutionize how businesses operate and deliver value.

This projection not only shows the increasing reliance on AI as a strategic tool for organizations to have a competitive advantage and thrive in today’s digital and data-driven world but also emphasizes the potential of AI to not only streamline processes and increase productivity but also create a new revenue streams and business models.

4. 55% of G2000 OEMs to Redesign Service Supply Chains Using AI

According to research conducted by IDC, by 2026, 55% of G2000 OEMs will redesign service supply chains using AI. This means that over half of these major manufacturers will use artificial intelligence to overhaul how they handle their service operations.

AI-based supply chain solutions will help organizations tackle supply chain challenges and mitigate potential disruptions. However, getting the most out of AI-based solutions is not a simple matter of technology; companies must take organizational steps to get the full value from AI.

5. 50% of Companies Will Have Implemented More Balanced Multi-shoring Sourcing Strategies to Better Address Risk by 2024

Multi-shoring sourcing strategies involve diversifying the sources of materials and components across multiple locations to reduce risks and improve reliability.

The IDC analyst predicts that by 2024, 50% of companies will have implemented more balanced multi-shoring sourcing strategies to better address risk. This is based on the need for companies to improve their supply chain resiliency and efficiency in the face of inflation and other challenges.

By implementing more balanced multiple-shoring sourcing strategies, businesses can improve their supply chain resiliency and reduce the impact of disruptions.

6. Global Chain is Expected to Experience a CAGR of 11.2% from 2020 to 2027

The COVID-19 pandemic has caused disruptions to supply chain operations and concerns about supply chain sustainability and corporate practices. Despite these challenges, the industry is expected to continue growing as more businesses and organizations come to rely on efficient supply chains.

According to Zippia, the global supply chain market is expected to experience a Compound Annual Growth Rate (CAGR) of 11.2% from 2020 to 2027. This growth rate is attributed to the increasing reliance on technology and globalization.

7. A 14% Annual Growth of Robotics Integration in the Supply Chain is Expected by 2025

According to a report by ABI research, the use of robots in warehouses is expected to increase significantly by 2025. The report predicts that more than 4 million robots will be in over 50,000 warehouses worldwide by 2025.

Moreover, a report by GlobeNewswire, states that the global logistics robot market is expected to be worth $12,739.1 million by 2025, registering a CAGR of 23.7% during the forecast period from 2017 to 2025. This report suggests that the logistics robot market size will surpass $12 billion by 2025.

In addition, Gartner’s report suggests that adopting digital supply chain technologies, including intralogistics smart robots that can be deployed in warehouses and distribution centers, will increase in the next three to five years. This states that the implementation of these robots is faster and less expensive, and they address the need to automate certain processes to supplement the human workforce.

Overall, the use of robotics in the supply chain is expected to grow annually by 14% by 2025. This growth rate shows a positive trend for the industry and suggests that more businesses are adopting robotics to improve efficiency and productivity in the supply chain.

Featured Download: Enjoying this article? If so, click here to accelerate your career:

Here are 75 ChatGPT prompts to 10x your productivity in procurement.

8. 63% of Organizations have Implemented Technological Solutions to Monitor and Assess the Efficiency of their Supply Chains.

The supply chain industry is undergoing a significant transformation, driven by the integration of advanced technologies. Artificial Intelligence (AI) is one of the technologies that companies are investing in to capture huge amounts of disaggregated data. According to a survey conducted by PWC, more than half of the executives and leaders surveyed have recognized the benefits of digitizing their supply chains and have made significant commitments. It was also found that 63% of organizations have implemented technological solutions to monitor and assess the efficiency of their supply chains.

Furthermore, the EY Industrial Supply Chain survey shows that 53% of respondents have already near or re-shored some of their operations in the last 24 months and 44% are planning new or additional near-shoring activities in the next 24 months. Additionally, McKinsey, states that 61% of manufacturing executives report decreased costs, and 53% report increased revenues as a direct result of introducing AI in the supply chain.

9. Global supply chain visibility experienced 22.4% growth in 2019

Global supply chain visibility has experienced an impressive 22.4% growth, highlighting the importance of transparency in supply chain operations. Visibility into all parts of the supply chain is vital and as supply chains continue to digitize, it is easier for organizations to seek insights related to visibility and transparency in all aspects of their supply chains.

The more visibility, the more its easier to avoid minor problems, which improves customer service. Additionally, transparency also improves the time to resolution to larger issues as they arise.

10. Only 53% of Supply Chain Leaders Possess Adequate Master Data Quality.

The McKinsey survey of global supply chain leaders highlights three interconnected pillars that form a resilient supply chain: Visibility, Scenarios, and Master data. However, only 53% of supply chain leaders possess adequate master data quality.

Comprehensive accurate master data is an essential foundation for both supply chain visibility and effective scenario planning. The quality of the data in supply chain planning systems is critical, and many companies still have room to improve their data collection and management processes. High-quality data is associated with lower levels of recent supply chain disruption, although the effect is less pronounced than with visibility or scenario planning.

To build a resilient supply chain, companies need to take steps to improve their master data quality. This can include building redundancy across suppliers, nearshoring, reducing the number of unique parts, and regionalizing their supply chains. Strengthening supply chain risk management and improving end-to-end transparency can also help companies create a comprehensive view of the supply chain through detailed sub-tier mapping, which is a critical step to identifying hidden relationships that invite risk.

11. 93% of Senior Supply-Chain Executives Intend to Make Their Supply Chains Far More Flexible, Agile, and Resilient

According to a survey conducted by McKinsey, 93% of senior supply-chain executives intend to make their supply chains far more flexible, agile, and resilient. This is in response to the challenges that have made the supply chain a widespread topic of conversation, including the COVID-19 pandemic, natural disasters, and geopolitical conflicts. The survey found that agility and resilience are highly complementary, and an agile supply chain is inherently more resilient. To be truly effective, however, this agility would need to extend into R&D, procurement, planning, manufacturing, and logistics.

The study also found that boosting supply chain resilience requires building it from the foundation and considering it in every element of supply chain design, organization, and operation. Other strategies to build resilient supply chains include creating a nerve center for the supply chain, simulating and planning for extreme disruptions, and reevaluating just-in-time strategies

12. 30% of Executives Prioritize Enhancing Resilience as a Critical Goal When Making Investments in Supply Chain Technology

According to PwC’s 2023 Digital Trends in Supply Chain Survey, only 30% of executives prioritize enhancing resilience as a critical goal when making investments in supply chain technology. This is in contrast to the higher responses for driving growth and optimizing costs, which were cited as top objectives by 53% and 37% of executives, respectively. The survey also found that increasing resilience is a lower priority for executives than other objectives such as improving customer experience, reducing risk, and improving sustainability.

However, PwC’s report on resilience and risk in supply chains highlights the importance of building resilience in supply chains to limit disruption and drive transformation. The report suggests that companies should introduce resilience metrics into supply chain KPIs, conduct regular stress tests and reviews, and create a nerve center for the supply chain to build resilience. PwC also recommends simulating and planning for extreme disruptions and reevaluating just-in-time strategies to enhance supply chain resilience.

McKinsey’s report on future-proofing the supply chain also emphasizes the importance of resilience, agility, and sustainability in supply chain design and operation. The report suggests that boosting supply chain resilience requires building it from the foundation and considering it in every element of supply chain design, organization, and operation. The report also recommends introducing resilience metrics into supply chain KPIs and conducting regular stress tests and reviews to ensure that resilience measures remain appropriate.

In summary, while only 30% of executives prioritize enhancing resilience as a critical goal when making investments in supply chain technology, building resilience in supply chains is crucial to limit disruption and drive transformation. Companies should introduce resilience metrics into supply chain KPIs, conduct regular stress tests and reviews, and create a nerve center for the supply chain to build resilience.

13. 57% of Businesses State that Disruptions in the Supply Chain Significantly Affect their Company’s Revenue

Disruptions in the supply chain can have a significant impact on businesses. According to a survey conducted by Hubs in November 2022, 57% of businesses state that disruptions in the supply chain significantly affect their company’s revenue. In addition, supply chain disruptions can cause significant negative losses in terms of finances (62%), logistics (54%), and reputation (54%). Despite this, many companies still don’t analyze the supply chain disruptions that they encounter due to a lack of supply chain visibility and internal coordination. COVID-19 was the second biggest cause of disruptions, affecting 57% of companies in 2022. Supply chain disruptions can cause as much as a 62% loss in finances

14. Respondents to a McKinsey survey believe they managed the transition to COVID-19 well, with 58% reporting good supply chain planning performance.

According to a survey conducted by McKinsey in the second quarter of 2021, 58% of respondents reported good supply chain planning performance during the COVID-19 pandemic. The survey included senior supply chain executives from various industries and geographies. The respondents were asked about the steps they had taken to shore up their supply chains over the past year, how those changes compared with the plans they drew up earlier in the crisis, and how they expect their supply chains to further evolve in the coming months and years.

The survey also found that 93% of respondents intended to make their supply chains far more flexible, agile, and resilient. The COVID-19 pandemic has put supply chains into the spotlight, and supply chain leaders have taken decisive action in response to the challenges of the pandemic, adapting effectively to new ways of working, boosting inventories, and ramping up their digital and risk-management capabilities.

15. IDC analysts predicted that by 2024, 50% of companies will adopt balanced multi-shoring sourcing strategies, leading to a 10 percentage point increase in supply reliability.

IDC analysts predict that by 2024, 50% of companies will adopt balanced multi-shoring sourcing strategies, leading to a 10 percentage point increase in supply reliability. This prediction is part of IDC’s FutureScape report, which outlines the top 10 predictions for the future of operations. The report suggests that companies will increasingly adopt multi-shoring strategies to better control risks of disruptions.

16. 40% of Asian-based Supply Chain Organizations Will Recover 2 Percentage Points of Margin by Prioritizing Multi-Shoring Supply Sourcing to Enhance Resilience and Reliability by the End of 2024

IDC predicts that by the end of 2024, 40% of Asian-based supply chain organizations will have rebalanced resiliency efforts to reflect the realities of inflation and necessary efficiency to recover 2 percentage points of margin. This prediction is part of IDC’s FutureScape report, which outlines the top 10 predictions for the future of operations. The report suggests that companies will increasingly adopt multi-shoring strategies to mitigate supply chain risks and improve supply chain resilience.

By prioritizing multi-shoring supply sourcing, Asian-based supply chain organizations can recover 2 percentage points of margin by the end of 2024, based on the IDC’s prediction. This will help these organizations to remain competitive and profitable in the long run.

17. 55.6% of Businesses Identified Cybersecurity as a Primary Worry for Supply Chain Resilience

As supply chains become increasingly complex and interconnected, the risk of cyber-attacks and data breaches is also increasing. In a recent survey conducted by the Business Continuity Institute (BCI), 55.6% of businesses identified cybersecurity as their primary worry for ensuring supply chain resilience. The survey collected data from 1,000 organizations across 82 countries, representing a range of industries. The survey also found that adverse weather, natural disasters, and energy scarcity were among the top concerns for supply chains over the next five years. The BCI’s Supply Chain Resilience Report 2023, sponsored by SGS, also found that cyber-attacks and data breaches were the top threat to supply chains over the next five years, despite being sixth on the list of supply chain disruptions for the last 12 months.

The BCI survey highlights the growing concern among businesses about the impact of cyber attacks on supply chain resilience. To ensure supply chain resilience, businesses need to prioritize cybersecurity and implement robust measures to protect their supply chains from cyber threats. In addition, businesses need to be prepared for other potential disruptions, such as adverse weather, natural disasters, and energy scarcity, which can also have a significant impact on supply chain resilience.

18. 65% of Respondents to Gartner’s Survey Said It Will Be Easier to Fund New Technology Investments

With the increasing complexity of supply chains, businesses need to prioritize technology investments to improve supply chain resilience and performance.

In a survey of 499 supply chain leaders conducted by Gartner from October through December 2022 in North America, Latin America, Western Europe, and the Asia/Pacific region, 65% of respondents said they anticipate it will be easier to fund new technology investments. This indicates that supply chain leaders are optimistic about the potential of technology to drive business outcomes and are willing to invest in technology to achieve their goals. The survey results suggest that supply chain leaders are prioritizing investments in technology that can help them improve their supply chain performance and drive growth.

This shows a positive sign for the future of supply chain management, as businesses continue to invest in new technologies to improve their operations.

19. Chief Supply Chain Officers (CSCOs) Plan to Allocate 73% of Their Supply Chain IT Budgets to Growth and Performance Enhancements in 2023

Gartner conducted a survey on Chief Supply Chain Officers (CSCOs) to understand their IT budget allocation for 2023. According to the survey, CSCOs plan to allocate 73% of their supply chain IT budgets to growth and performance enhancements in 2023. This indicates that CSCOs are prioritizing investments in IT that can help them improve their supply chain performance and drive growth. The survey results suggest that CSCOs are optimistic about the potential of IT to drive business outcomes and are willing to invest in IT to achieve their goals.

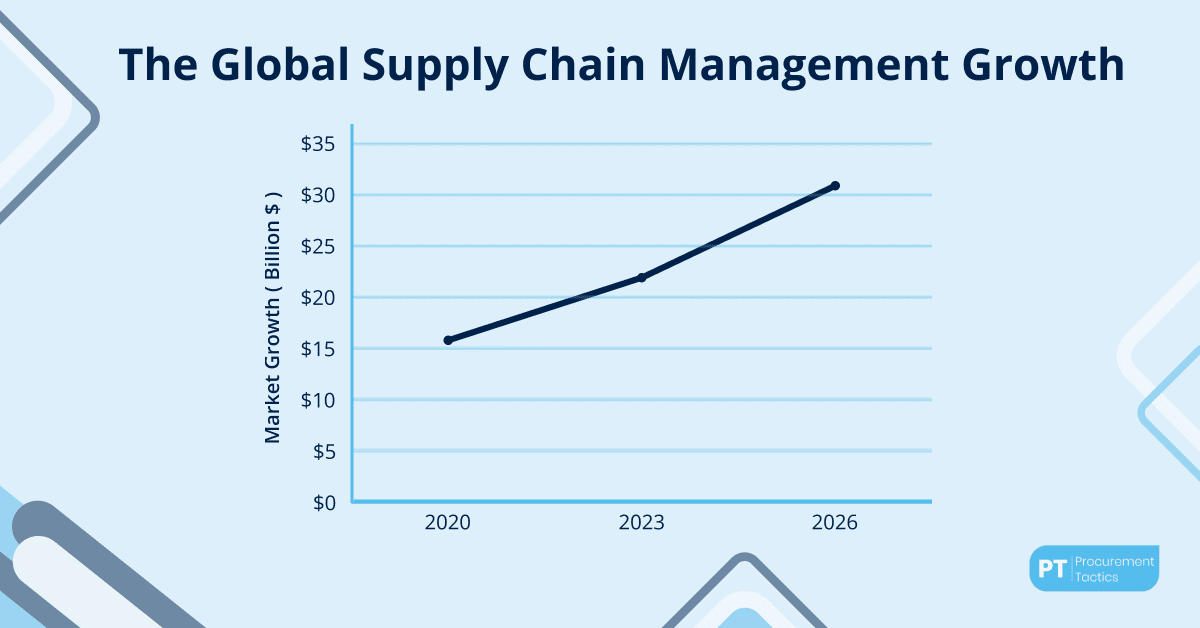

20. The Global Supply Chain Management Is Worth $21.95 Billion

According to Fit Small Business, the global supply chain management market has steadily grown from $15.85 billion in 2020 to $21.95 billion in 2023 and is expected to reach $30.91 billion by 2026.

21. The Average Cost Of A Supply Chain Disruption Is $1.5 Million Per Day.

Supply chain disruptions can have a significant impact on a company’s bottom line. The cost of supply chain disruptions can vary greatly depending on the industry and the specific circumstances of the disruptions.

According to a survey conducted by Supply Chain Dive, the average cost of a supply chain disruption is $1.5 million per day. However, this cost varies depending on the industry. For example, in the pharmaceutical industry, the average cost of a supply chain disruption is $1.5 million while in the manufacturing industry is $610,000. The retail industry has an average cost of $1.1 million, the oil and gas industry has an average cost of $2.5 million, and the high-tech industry has an average cost of $3.5 million.

However, according to the latest report by Interos, the costs from supply chain disruptions have dropped by over 50%.

22. The Global Shortage Of Lumber Has Caused The Price Of Wood To Increase By 300% Since 2020

The global shortage of lumber has caused the price of wood to increase by 300% since 2020. The COVID-19 pandemic led to an unprecedented increase in the U.S. price of softwood lumber by more than 300%. This increase is due to the pandemic-induced lockdowns, which increased the demand for lumber as buyers shifted expenditures from other areas. Aside from this, the pandemic also triggered a worker shortage in many sectors, including the lumber industry, which further contributed to the increase in prices. Additionally, higher U.S. tariffs on Canadian lumber and high labor costs have also played a role in the increase in prices.

Despite high prices, lumber companies have been unable to increase production rapidly due to a variety of market factors such as the availability of timber and labor, as well as planning and carrying out expansion projects. Lumber production in Canada and the U.S. has not increased significantly from pre-pandemic levels and is not expected to before early 2022.

23. Average Consumer Spending an Extra $1,200 per Year Due to Supply Chain Disruptions

The Conference Board reports that the average consumer is spending an extra $1,200 per year on goods and services due to supply chain disruptions. These disruptions have incurred substantial financial costs, averaging 6-10% of annual revenues, as well as reputational costs. Supply chain disruptions have contributed to an average of about 60% of the run-up of U.S. inflation during the past two years.

Supply chain leaders predict that food, gas, and computer chips will be most at risk of impact in 2023. Inflation reduces the spending power of consumers and as prices quickly rise, demand is converted to substitute products, but some buyers are leaving the market altogether.

24. RFID Tags can Increase Inventory Accuracy up to 95%

Radio Frequency Identification (RFID) is a valuable tool for businesses looking to optimize their operations and streamline inventory tracking and management. According to AJG Transport, by implementing RFID tags, inventory could reach as high as 95%. This is a significant improvement from the average inventory accuracy of 65% without RFID tags.

RFID tags provide real-time inventory tracking, which means that inventory data is always up-to-date and accurate. The RFID tags can be read quickly and accurately, reducing the possible errors that can occur with manual tracking methods. RFID readers can capture information from multiple tags simultaneously, reducing the risk of missing or misreading data.

This technology can help businesses automate their inventory-tracking processes, minimizing the amount of time and resources required for manual tracking. RFID location tracking has been shown to boost shipment from 31% to more than 99%. Retailers are mandating RFID because it can improve store inventory to 98% accuracy, up from 70% accuracy.

The capabilities that RFID track and trace affords and the improvement you’ll see using this technology could determine whether or not you survive the difficult global supply chain challenges we’re seeing today.

25. 70% Of Companies Consider Supply Chains As A Crucial Factor In Delivering Excellent Customer Service.

Customer service is a critical component of logistics and supply chain management. According to a supply chain survey conducted by GEODIS, up to 70% of business organizations believe their supply chains are either “extremely” if not “very” complex. The supply chain is only complete when the product has reached the customer, and customer service plays a vital role in dealing with logistics.

Customer service knows all the pain points and the demands of the clients, and this data can help to improve the supply chain. The key role of customer service within the supply chain is customer satisfaction. Without being able to satisfy customers through the product itself, the service, the speed of delivery, and with transparency of the process, businesses will be left behind the competition.

Modern businesses work hard to integrate customer service into their supply chain. Companies need to adapt to a dynamic market and consider customer experience as the most crucial factor for a successful supply chain.

26. 43% Of Small Businesses Do Not Track Their Inventory

According to AJG Transport, 43% of small businesses do not track their inventory. This means that almost half of small businesses may have difficulty accurately serving their customers. Of those who do track inventory, the most common method is inventory through accounting software like QuickBooks, at 24% of small business owners.

The lack of inventory tracking can lead to several issues for small businesses, such as overstocking, stockouts, and inaccurate forecasting. Overstocking can lead to increased storage costs and waste, while stockouts can result in lost sales and dissatisfied customers. Inaccurate forecasting, on the other hand, can lead to poor decision-making and inefficient use of resources. Inventory management software can help small businesses overcome these challenges by providing real-time visibility into inventory levels, automating manual processes, and generating accurate forecasts. Despite the benefits, only 18% of small businesses use inventory management software.

This highlights the need for more education and awareness about the importance of inventory tracking and the benefits of using inventory management software.

27. The Average Lead Time For Goods To Travel From China To The United States Has Increased By 50% Since 2019.

According to CNBC, the average lead time for goods to travel from China to the United States has increased by 50% since 2019. The COVID-19 pandemic has led to restrictions in the transportation and movement of goods and materials, especially on routes that pass through restricted or containment areas, which led to higher lead times. In regular conditions, the rule of thumb for lead times is 1-2 weeks for regular post, 3 days for air express freight, 8-10 days for air freight, and 30-40 days for ocean freight. However, transit times can be impacted by location, shipment size, and season. Other factors that can impact freight rates include seasonality, current events, and capacity.

28. Supply Chain Disruptions Result in a 3-5% Increase in Expenses and a 7% Decrease in Sales

Supply chain disruptions can have a significant impact on a business’s financial performance. According to Gitnux, supply chain disruptions can result in a 3-5% increase in expenses and a 7% decrease in sales. This highlights the importance of achieving full transparency of all links in the supply chain to mitigate these risks.

29. Daily Performance Indicators For Supply Chain Optimization Include Cost Reduction (35%), Production Service Rate (29%), Inventory Turn (28%), And Production Time (27%)

Supply chain metrics or key performance indicators (KPIs) are used by businesses to assess and optimize the efficiency and productivity of various processes and activities. By monitoring and optimizing relevant KPIs and metrics, businesses can set solid benchmarks for essential processes and activities, spot inefficiencies, capitalize on current strengths, and establish goals that help their supply chain scale with the success of their company.

There are several supply chain KPIs that businesses can use to track their performance. According to AJG Transport, some of the most important daily performance indicators include Cost Reduction (35%), Production Service Rate (29%), Inventory Turn (28%), And Production Time (27%) which help businesses to optimize their supply chain and reduce costs. Cost reduction is the most important performance indicator, followed by production service rate, inventory turnover, and production time.

Reducing transportation time can help to lower inventory carrying costs, which can contribute to cost reduction. Developing a mathematical model can also help mitigate disruptions in a three-stage supply chain, which can help businesses optimize their supply chain and improve their performance indicators.

Overall, these indicators can help businesses to optimize their supply chain and reduce costs.

30. Survey of 499 Supply Chain Leaders by Gartner Reveals the Need for Awareness of Strategic, Disruptive, and Inevitable Technologies

Based on the survey of 499 supply chain leaders by Gartner, supply chain leaders need to be aware of the strategic, disruptive, and inevitable technologies that will affect their planning processes in the next five years. The survey revealed that 65% of supply chain leaders believe that adapting to new technology is the most important strategic change supply chain organizations will face five years from now. Additionally, 52% of supply chain leaders polled viewed AI as an “important and disruptive” technology and 40% indicated the same for digital supply.

Gartner analysts have identified the top eight supply chain technology trends that will receive much investment, including hyper-automation 2.0, next-generation robots, autonomous things, digital supply chain twin, analytics everywhere, security mesh, ecosystem collaboration, and sustainability tools.

Supply chain leaders must have an understanding of the strategic, disruptive, and unavoidable technologies that will impact their planning processes over the next five years.

31. The Number Of Container Ships Waiting To Dock At The Port Of Los Angeles Has Reached An All-Time High Of 100

According to The Wall Street Journal, the number of container ships waiting to unload cargo at the Port of Los Angeles has reached a record-breaking 73 ships, which is nearly double the number from a month ago. This number continued to rise and reached a peak of 100 ships in the following months. The backup of container ships off Southern California’s coast was at the heart of U.S. supply chain congestion during the COVID-19 pandemic. The situation has improved since then, and officials declared an end to the backup of ships at Southern California’s ports in November 2022.

32. Global Food Shortage to Affect 100 Million People by End of 2023

According to the World Food Programme, the global food shortage is expected to affect 100 million people by the end of 2023. This is due to a combination of factors such as economic shocks, climate change, and conflicts. In 2022, around 258 million people across 58 countries and territories faced acute food insecurity at crisis or worse levels. WFP estimates that more than 345 million people face high levels of food insecurity in 2023, which is more than double the number in 2020. The number of people experiencing acute food insecurity and requiring urgent food and livelihood assistance is on the rise. The global community must act now to prevent hunger on a catastrophic scale.

Without urgent life-saving action, over 40 million people across 51 countries are in Emergency or worse levels of acute food insecurity in 2023. The latest Hunger Hotspots report notes that 970,000 people in Afghanistan, Ethiopia, Somalia, South Sudan, and Yemen are already facing or expected to face catastrophic food insecurity – ten times more than five years ago. Humanitarian action will be critical to preventing further starvation and death.

33. Global supply chain disruptions to result in a $1.5 trillion loss in 2023

According to the World Economic Forum’s Global Risks Report 2023, continued supply chain disruptions could lead to sticky core inflation, particularly in food and energy, which could fuel further interest rate hikes. The report also states that global supply chain disruptions will result in a loss of $1.5 trillion in value in 2023. These risks are being amplified by the persistent health and economic overhang of a global pandemic, a war in Europe, and sanctions that impact a globally integrated economy. Even if the economic fallout remains comparatively contained, global growth is forecast to slow to 2.7% in 2023, with around one-third of the world’s economy facing a technical recession.

The Future of Jobs Report 2023 also highlights that the largest losses are expected in supply chain and transportation, with a projected loss of 5.9 million jobs globally. The report further explains that disruptions such as threats to the resilience of value chains due to COVID-19 and geopolitical conflict may make doing business locally more attractive than relying on the stability of global supply chains. These global trends have led to businesses considering ways to enhance resilience in their supply chains, through “nearshoring”, “friend-shoring” and other ways to distribute risk.

34. 50% of Businesses Increased Spending on Supply Chain Technology in 2023

According to a survey conducted by Gartner, 50% of businesses have increased their spending on supply chain technology in 2023. The survey was conducted among 499 supply chain leaders from North America, Latin America, Western Europe, and the Asia/Pacific region from October to December 2022. The survey also found that 73% of supply chain IT budgets this year will be allocated to growth and performance enhancements, on average.

To help guide investment decisions, Gartner analysts have presented the top eight supply chain technology trends that will receive much of that investment. The trends include the use of artificial intelligence (AI) and advanced analytics, automation, digitalization, and visibility tools. Supply chain leaders must have an understanding of the strategic, disruptive, and unavoidable technologies that will impact their planning processes over the next five years. In addition, the Gartner Supply Chain Technology Users Wants and Needs Survey found that 36% of the companies responding indicated technology leadership reporting directly within the supply chain organization. This percentage is expected to rise with the progression of digital supply chain initiatives.

Overall, the increased spending on supply chain technology in 2023 reflects the growing importance of technology in supply chain management. Supply chain leaders must prioritize investments in technologies that can enable supply chain strategy and foster competitive advantage.

35. 30% Of Businesses Say They Have Had To Delay Or Cancel Product Launches Due To Supply Chain Disruption

The COVID-19 pandemic has caused significant disruptions to global supply chains, affecting businesses of all sizes and industries. As a result, many companies have had to delay or cancel product launches due to supply chain disruptions. According to PWC, 30% of businesses have experienced such delays or cancellations. This highlights the importance of having a resilient and agile supply chain that can adapt to unexpected disruptions. Companies are increasingly recognizing the need to digitize their supply chains and build resilience to mitigate risks and limit disruption.

Supply chain disruptions can be caused by various factors, such as parts shortages, shipping delays, and transportation delays. To manage and respond to supply chain disruptions, companies need to optimize their supply chain planning, logistics, and procurement, and build more transparency and intelligence into their operating models.

Manufacturers must also take a hard look at their existing operating models and repurpose their supply chains to become more digitally enabled, resilient, and agile. The US government has established a Supply Chain Disruptions Task Force to monitor and address short-term supply issues.

36. 20% of Businesses Increase Prices Due to Supply Chain Disruptions

According to Ernst and Young, 72% of supply chain executives experienced a negative effect due to the disruption caused by the pandemic, and almost every industrial products representative (97%) and every automotive representative reported a negative effect. As a result of the supply chain disruptions, 20% of businesses have had to increase their prices. The financial impact of supply chain disruption ranges from a lack of resources on the production line to a lack of container space at the ports and a shortage of raw materials at far-tier suppliers.

The disruptions have caused shortages of products and materials, which have delayed and stalled revenue-building business activity. The disruptions to supply chain operations are set to stay in 2023, according to KPMG

37. 20% Increase in Average Product Delivery Time since 2020

Since 2020, the average time it takes to get the product from supplier to customer has increased by 20% according to The increase in delivery time may be due to several factors including a surge in online shopping and e-commerce deliveries, which rose by 25% in 2020. The disruptions to the maritime shipping sector caused by the COVID-19 pandemic resulted in delayed merchandise shipments, with turnaround times on routes from China to the United States and Europe increasing from an average of 60 days before the pandemic to 100 days in December 2020. Shipping costs are also an important driver of inflation around the world, and when freight rates double, inflation picks up by about 0.7 percentage points. The increase in delivery time highlights the importance of optimizing the supply chain to improve delivery times and meet customer expectations.

38. Supply Chain Delays Led Businesses to Lose 15% of Annual Revenue

According to Anvyl, almost 60% of small and mid-sized businesses reported losses of up to 15% or more in revenue due to supply chain delays. The COVID-19 pandemic has affected global supply chains at an unprecedented speed and scale leading to a decline in demand in some sectors and a sudden spike in demand in others. Economic activities came to a standstill in many countries and the outbreak has affected every aspect of business, particularly global supply chains. Furthermore, the Hackett Group also published research about this topic, which revealed that revenue loss is one of the three main business impacts of supply chain disruptions.

These findings emphasize the significant impact that supply chain disruptions can have on businesses, particularly on small and mid-sized companies.

39. Cost of Goods Sold Increased by 7% in H1 2022 Due to Supply Chain Disruptions, Material Input Cost Increases, and High Inflation

According to IHS Markit, the cost of goods sold has increased by 7% in the first half of 2022 due to supply chain disruptions, material input cost increases, and high inflation. This has made cost savings difficult to find this year as every market is experiencing upward price pressure. The cost of developing upstream oil and gas assets has increased by over 7% in the first half of 2022. The global Upstream Operating Costs Index (UOCI) has increased by 6.7% in the first half of 2022 driven by rising raw material prices and continuing supply/demand disruption, which fed through into steel products, equipment, and chemicals.

The electronics industry has also been hit by escalating supply chain disruptions, with the IHS Markit Global Electronics Input Prices Index continuing to rise rapidly during the third quarter of 2021.

40. The Global Average Cost Of A Data Breach Is $4.45 Million

According to the most recent IBM study, the global average cost of a data breach in 2023 was $4.45 million, which is a 15% increase over three years. This is higher than the previous year’s average cost of $4.35 million. The report emphasizes that faster detection, response, and recovery from threats are essential to limit losses. Organizations using AI and automation had a 74-day shorter breach lifecycle and saved an average of $3 million more than those without.

41. The global logistics automation market has a predicted CAGR of 14.7%

The global logistics automation market includes hardware and software solutions that automate logistics processes such as transport, storage, retrieval, and data management processes. Automating these processes improves efficiency, minimizes errors, and reduces the turnaround time. The market is expected to grow at a compound annual growth rate (CAGR) of 14.7% from 2023 to 2030. This is higher than the previous search results that mentioned a predicted CAGR of 12.4%. According to the report of Grand View Research, Inc. the market size accounted for USD 30.90 billion in 2022 and is expected to reach around USD 90.00 billion by 2030.

42. The Global Digital Twin Market For Supply Chain Is Expected To Reach $4.1 Billion By 2026

According to Growth Market Reports, the global digital twin market for supply chains is expected to grow significantly in the coming years. The most current statistic shows that the global digital twin market was valued at USD 11.13 billion in 2022 and is projected to grow at a CAGR of 37.5% from 2023 to 2030, reaching USD 155.83 billion by 2030. This is a significant increase from the previous estimate of USD 4.1 billion by 2026.

The growth of the digital twin market is driven by the emergence of Industry 4.0, the Industrial Internet of Things (IIoT), and the use of digital twin technology in the manufacturing and healthcare industries. The automotive and transportation industry is expected to account for the largest share of the digital twin market during the forecast period

The COVID-19 pandemic had a significant impact on the digital twin market, leading to supply chain disruptions and production halts during the pandemic in 2020. However, the increasing application of the technology is likely to boost the digital twin market growth post-pandemic.

43. Supply chain digitization leads to 20% lower operating costs and 11% greater EBIT for companies in the top quartile

Supply chain digitization can lead to significant cost savings and increased profitability for companies in the top quartile. The benefits of supply chain digitization include efficiency and automation, improved decision-making, collaboration and connectivity, data-driven planning and analysis, and improved customer experience. By embracing supply chain digitization and leveraging these benefits, companies can achieve 20% lower operating costs and 11% greater EBIT based on the Important Supply Chain Statistics and Trends 2023 & Beyond.

44. Raw Material Costs Identified as Top Supply Chain Threat for 2023 by 71% of Global Companies

A recent report by KPMG reveals that 71% of global companies have identified raw material costs as their number one supply chain threat for 2023. This statistic highlights the significant impact that raw material costs can have on supply chain operations and overall business performance. The increasing prices and availability fluctuations of key commodities such as fuel, construction items (timber, steel, and resin), and plastic for packaging are among the challenges faced by organizations.

45. Education Levels of US Supply Chain Managers: Majority Hold Bachelor’s Degrees

Zippia reports that 70% of US supply chain managers have a bachelor’s degree, 17% have a master’s degree, 9% have an associate degree, and only 2% have a high school diploma. Supply chain managers with a master’s degree earn a higher salary than those with a bachelor’s degree or a high school diploma. The education statistics for supply chain logistics managers and supply chain specialists are similar to those of supply chain managers. A higher education level is beneficial for supply chain managers in terms of salary and career advancement opportunities.

46. Employment of Logisticians Projected to Grow 30% from 2020 to 2030

According to the U.S. Bureau of Labor Statistics, the employment of logisticians is projected to grow 30% from 2020 to 2030, which is much faster than the average for all occupations. This growth is due to the increasing need for companies to streamline their supply chain operations and improve efficiency. The job outlook for logisticians is positive, with about 24,800 openings projected each year, on average, over the decade. A bachelor’s degree is typically required to enter the occupation, although an associate’s degree may be sufficient for some logistician jobs. The median annual wage for logisticians was $77,030 in May 2021. Logisticians work in nearly every industry, and the job can be stressful because logistical work is fast-paced.

47. Global Warehouse Robotics Market Expected to Reach $17.29 Billion by 2030

According to Grand View Research, The global warehouse robotics market is expected to reach USD 17.29 billion by 2030, growing at a compound annual growth rate (CAGR) of 19.6% from 2023 to 2030. The growth is attributed to factors such as the growing e-commerce and retail industries, labor shortage, and rising demand to increase the throughput of warehouse operations. Warehouse robotics offers enhanced facility safety as it takes over hazardous jobs that put workers at risk.

The major players in the global warehouse robotics market include ABB, Bastian Solutions LLC, Daifuku Co. Ltd., Dematic, Fetch Robotics Inc., Honeywell International Inc., KNAPP AG, KUKA AG, OMRON Corporation, YASKAWA Electric Corporation, and FANUC Corporation

48. The top areas that businesses report prioritizing for supply chain sustainability are electrification (40%) and natural resource management (29%)

A recent survey of 525 senior supply chain executives found that electrification and natural resource management are the top priorities for supply chain sustainability, with 40% and 29% of businesses prioritizing these areas, respectively. However, the survey also found that many companies struggle to measure the return on their sustainability activities and that some are focused primarily on savings and efficiency rather than broader sustainability goals.

To achieve sustainable supply chains, companies need to establish long-term sustainability goals and include lower-tier suppliers in an overall sustainability strategy. Other drivers of sustainable supply chain management include regulatory and market pressures. Collaboration and transparency are also important for achieving sustainable supply chains. Overall, companies need to take a holistic approach to sustainability and consider factors such as ethical sourcing, fair trade, and efficient use of resources to achieve long-term success.

49. Majority of Customers Would Abandon a Company After One or Two Late Deliveries.

Late or inaccurate deliveries can have a significant impact on customer loyalty, leading to lost customers and decreased revenue for retailers. Recent surveys conducted by Voxware, indicate that the majority of customers would abandon a company after one or two late deliveries. Specifically, 65% of customers said they would abandon shopping with a retailer altogether after two to three late deliveries, while 16% of respondents will abandon shopping with a retailer altogether if they receive an incorrect delivery just one time, and 14% will do so if they receive a late delivery just one time.

Late deliveries can also lead to negative reviews and ratings, which can further damage a retailer’s reputation and lead to lost customers. Additionally, 32% of customers cited late deliveries as an issue when online shopping and 46% cited expensive delivery costs as a problem.

These statistics emphasize the importance of providing a positive delivery experience to customers, including on-time delivery, accurate deliveries, and low shipping costs. Retailers should also prioritize better fulfillment and shipping, as well as providing good customer service, to avoid losing customers due to late or inaccurate deliveries.

50. 82% of Supply Chain Leaders Experienced at Least One Significant Supply Chain Disruption in 2022, and 50% Experienced Three or More

The past two years have been marked by one supply chain disruption after another, including global supply chain delays, the ongoing pandemic, the Russian invasion of Ukraine, and talent shortages. In 2022, more than 80% of organizations experienced at least one significant supply chain disruption, and 50% experienced three or more. Material shortages were the top challenge, affecting 60.9% of participants. Supply chain leaders predict that food, gas, and computer chips will be most at risk of impact this 2023.

Despite the challenges, companies are increasingly recognizing the importance of preparing for supply chain disruptions, with 70% of participants implementing measures to improve their supply chain resilience. However, more than half of logistics managers at major companies and trade groups do not expect the supply chain to return to normal until 2024 or after.

51. 61% of supply chain organizations identify technology as a source of competitive advantage, and 20% identified emerging technologies as critical investment areas

6 in 10 companies plan to invest in digital technology to bolster their supply chain processes, data synthesis, and analysis capabilities. Technology investment is accelerating, and companies are prioritizing technology investment in supply chain planning capabilities and end-to-end visibility enabled by real-time analytics to maintain operational stability. In a recent Gartner survey, 61% of respondents said technology is a source of competitive advantage, and 20% identified emerging technologies as critical investment areas, with 20% investing in robotics. Companies need to unify their technology portfolio and update their legacy systems to stay competitive.

To make the most of technology capability for insights-led decision-making, companies should fast-track their data management policies and capabilities and upskill their teams. Automation can replace redundant manual supply chain activities, drive productivity gains, and protect against margin squeeze and cost increases.

52. Global GDP was forecasted to grow by 3.6% in 2023 before the war, but the latest forecasts show only 1.3% growth for the year

Before the war, the global GDP was forecasted to grow by 3.6% in 2023. However, the latest forecasts show only 1.3% growth for the year, indicating a significant impact of the ongoing conflict between Russia and Ukraine on the global economy. The OECD Economic Outlook report projects a moderation of global GDP growth from 3.3% in 2022 to 2.7% in 2023, followed by a pick-up to 2.9% in 2024. The World Bank’s Global Economic Prospects report projects the global economy to grow by 1.7% in 2023 and 2.7% in 2024, with forecasts in 2023 revised down for 95% of advanced economies and nearly 70% of emerging market and developing economies.

The Conference Board’s Global Economic Outlook report forecasts global real GDP to grow by 2.6 percent in 2023, down from 3.3 percent in 2022, with most of the weakness concentrated in Europe, Latin America, and the US. The ongoing conflict between Russia and Ukraine is expected to continue to impact the global economy, and businesses need to prepare for a slowing global economic growth environment in the coming years.

53. Deliveries in 2023 and 2024 are expected to be 2.6 times higher than the average, with a total of 5.1 million twenty-equivalent units (TEUs) added to the fleet.

According to historical delivery data from Clarksons, the average annual fleet growth was 970,000 TEUs between 2001-2020. However, the deliveries expected in 2023-24 are predicted to be 2.6 times higher than the average, with a total of 5.1 million twenty-equivalent units (TEUs) added to the fleet. The container industry is experiencing a boom, and the market could struggle to absorb all these new ships.

As of May 2023, the Mediterranean Shipping Company’s ships had a capacity of around five million twenty-foot equivalent units (TEUs), topping the list of leading container ship operators. The French container company CMA CGM Group owned ships with a total capacity of around 1.7 million twenty-foot equivalent units as of May 2023. The Port of Long Beach provides monthly and annual container counts measured in Twenty-Foot Equivalent Units (TEUs), a standardized maritime industry measurement used when counting cargo containers of varying lengths. The new deliveries are expected to break records, leading to a significant increase in the global container fleet.

54. Carrier rates are a key driver of freight forwarders’ gross profit.

Freight forwarders are asset-light intermediaries with flexible cost structures. Carrier rates play a crucial role in their gross profit, with between 62% and 85% of revenues spent on purchasing carrier capacity, such as shipping lines or cargo airlines. The remaining 20 to 30 percent is typically converted into gross profit. The supply chain crisis has led to an increase in freight rates, which has implications for freight forwarders’ earnings. Understanding the relationship between rates and earnings can help freight forwarders navigate the volatile forwarding market.

Freight forwarders work with carriers to negotiate the best shipping rates and routes for their clients. They also handle customs and paperwork. Freight forwarders can help resolve supply chain snags and consolidate shipments to optimize speed, cost, and reliability. These companies can use their large market shares to influence shipping capacity and rates, which can disadvantage American exporters. Freight forwarders are looking to consolidate shipments to drive freight efficiencies in the future.

55. 73% of consumers are willing to pay more for sustainable products.

A joint study by McKinsey and NielsenIQ found that 73% of consumers are willing to pay more for sustainable products. The study examined sales growth for products that claim to be environmentally and socially responsible and found that products with ESG-related claims on their packaging outperformed products that made none. This indicates that consumers are backing their stated ESG preferences with their purchasing behavior.

The study also found that more than 60% of respondents said they’d pay more for a product with sustainable packaging. Sustainability is becoming an increasingly important factor for consumers when making purchasing decisions, and companies that prioritize ESG initiatives may have a competitive advantage in the marketplace.

56. Global Air Cargo Demand Falls by 14.9% in January 2023 Compared to January 2022

Global demand for air cargo fell by 14.9% in January 2023 compared to January 2022, indicating a decline in cargo demand due to persisting economic headwinds. The decline in demand is attributed to a persisting war in Ukraine, high inflation, and a shortage of workers. The International Air Transport Association (IATA) released its data for January 2023 global air cargo markets and reported that:

- Global demand, measured in cargo tonne-kilometers (CTKs), fell by 14.9% compared to January 2022 (-16.2% for international operations).

- Available capacity in the region increased by 8.8% compared to January 2022.

- North American carriers posted an 8.7% decrease in cargo volumes in January 2023 compared to the same month in 2022. This was a slight decrease in performance compared to December (-8.5%). Capacity increased by 2.3% compared to January 2022.bureau

- Middle Eastern carriers experienced an 11.8% year-on-year decrease in cargo volumes in January 2023. This was an improvement from the previous month (-14.4%). Capacity increased by 9.6% compared to January 2022.

- African airlines saw cargo volumes decrease by 9.5% in January 2023 compared to January 2022. This was an improvement in performance compared to the previous month (-10%). Capacity was 1.8% below January 2022 levels.

The air freight market has begun a difficult year, with the fall in cargo volumes and the increase in transport capacity causing freight rates to drop. The decline in demand is a result of persisting economic headwinds, including the ongoing war in Ukraine, high inflation, and a shortage of workers. Despite the challenges, the IATA reports that air cargo demand has been strengthening since February 2023.

57. Only 22% of Companies Have a Proactive Supply Chain Network

A recent study by the Logistics Bureau found that only 22% of companies have a proactive supply chain network, meaning that they can address shifts in supply or demand before they become critical. This lack of proactive supply chain management was exposed as a significant vulnerability during the pandemic, as supply chain disruptions can cause problems for businesses of all sizes. Furthermore, 43% of small businesses do not track their inventory, making it difficult to serve customers accurately.

Supply chain visibility is a top strategic priority for companies worldwide, with only 6% of companies reporting full visibility on their supply chain. By proactively addressing supply chain disruptions, companies can improve their resilience and better serve their customers.

58. Supply Chains May Take 2-3 Years to Recover from Disruptions

The supply chain industry has been facing instability due to various disruptions such as port strikes, rail strikes, inflation, and driver shortages. Experts predict that it may take supply chains close to 2-3 years to turn around. This lack of proactive supply chain management was exposed as a significant vulnerability during the pandemic, as supply chain disruptions can cause problems for businesses of all sizes.

More than half of executives do not expect a return to a “normal” supply chain until the first half of 2024 or beyond, while 22% expect disruptions to continue until the second half of 2023. COVID-19 lockdowns in China, the war in Ukraine, and climate change are among the headwinds that will continue to impact supply chains in 2023.

The possibility of railway and port strikes also threatens to re-tangle supply chains in the US. The supply chain industry is urging companies to take a proactive approach to supply chain management to address visibility gaps so that end-users can identify and act on changes. By proactively addressing supply chain disruptions, companies can improve their resilience and better serve their customers.

59. E-commerce drives a 33% increase in the return rate of overall retail sales, indicating the significant impact of e-commerce on reverse logistics supply chain management.

E-commerce has caused a significant increase in the return rate of overall retail sales, with a 33% increase in the return rate being reported by Deloitte. This has highlighted the need for retailers to have an efficient reverse logistics supply chain management system in place to handle the increased returns. The average return rate for e-commerce sales is around 20-30%, which is 2-3 times higher than brick-and-mortar stores.

The high return rate can have detrimental effects on profit margins, conversion rates, and the overall viability of a business. However, offering free returns or exchanges can influence buyers to purchase from a brand. Therefore, retailers must focus on reducing the number of returns and improving the return process to remain competitive in the industry.

Returns are a major cost for online retailers, with an estimated $550 billion spent on return logistics in 2020. The increase in the adoption of reverse logistics services to enhance the customer experience is the key driving factor propelling the growth of reverse logistics

60. 23% Increase in Earnings from Sustainable Supply Chain Initiatives

Investing in sustainable practices can bring significant financial benefits to businesses. Companies that have invested in sustainable supply chain initiatives have seen an average of 23% increase in earnings. The benefits of sustainable practices go beyond cost savings to increased productivity, profitability, and better management of operational risks.

Sustainability is not only beneficial for the environment but also for businesses. According to a survey of 525 senior supply chain executives conducted by EY in 2022, 25% of companies had already experienced increased revenue due to their supply chain sustainability efforts. Sustainable supply chain investments can add 12% to 23% to value chain revenue. The most sustainable programs are the ones that are win-win, creating positive impacts on the environment and benefiting the company’s bottom line. Companies that invest in digitization and sustainability can increase revenue, reduce costs, and improve efficiency. Therefore, companies need to consider building sustainability into each supply chain competency area to secure long-term value for their organization.

61. Cloud Logistics Software Market Expected to Grow at a CAGR of 10.2% from 2023 to 2026

The cloud logistics software market is expected to grow at a CAGR of 10.2% from 2023 to 2026, according to recent research. This growth is driven by factors such as the need for improved supply chain visibility and the growing demand for real-time tracking of shipments. The market is expected to see significant growth due to the increasing adoption of digital transformation across the logistics industry. The cloud supply chain management market is analyzed to grow at a CAGR of 11.09% during the forecast period (2022 – 2027).

62. Cyber Risks Have the Deepest Impact on Supply Chains

According to WTW 2023 Global Supply Chain Risks Report, cyber risks are believed to have the deepest impact on supply chains, rated 34% as a high impact and 54% as a medium. Cybersecurity breaches in the supply chain have become a significant concern for organizations. The most common risks affecting supply chain companies are data leaks, breaches, and malware attacks. Supply chains can be particularly prone to cyber threats because they are composed of multiple vendors, manufacturers, and other third-party organizations, and determining which entity is responsible for an incident can be difficult.

The impact of cyber risks on supply chains can be severe, with 98% of organizations surveyed reporting negative impacts from a cybersecurity breach that occurred in their supply chain. Cyber risk management is essential to running a secure supply chain and third-party risk program. By implementing best practices such as regular third-party risk assessments, businesses can address common cybersecurity risks in the supply chain.

As cyber threats continue to grow and advance globally, organizations worldwide are beginning to look beyond the tech-centric and threat focus toward the potential positive impact of cyber. Therefore, it is crucial for businesses to prioritize cybersecurity and implement robust measures to mitigate cyber risks in their supply chains

63. 67% of supply chain leaders have implemented digital dashboards for end-to-end supply chain visibility

Supply chain leaders are increasingly implementing digital dashboards for end-to-end supply chain visibility. According to a recent survey by McKinsey, 67% of supply chain leaders have implemented digital dashboards for end-to-end supply chain visibility. This is a significant improvement in supply chain visibility, which is essential for managing supply chain disruptions.

Companies with digital dashboards were twice as likely as others to avoid supply chain problems caused by the disruptions of early 2022. Supply chain leaders are also prioritizing technology investment in supply chain planning capabilities and end-to-end visibility enabled by real-time analytics. Real-time analytics is another critical tool for managing complex supply chains. By using real-time analytics, companies can identify potential disruptions and take proactive measures to mitigate them.

64. 79% of Companies with Strong Supply Chains Achieve Revenue Growth That Is Significantly Above Average

Companies with strong supply chains achieve revenue growth that is significantly above average, with 79% of such organizations achieving this level of growth. According to a survey of more than 400 executives in manufacturing and retail across the globe by Deloitte, organizations with superior supply chain capabilities demonstrate significantly above-average performance on both revenue growth and EBIT measures when compared to the industry average. In contrast, only 8% of organizations with lower-performing supply chains achieve revenue growth that is significantly above average.

Supply chain leaders are embracing their expanded strategic role in global organizations and the growing expectations of the function. However, a report by Accenture found that more than 75% of companies are missing growth opportunities in the supply chain. Only 10% of companies were building customer-centric supply chains that were resilient prior to the COVID-19 pandemic. Therefore, it is essential for companies to prioritize supply chain management and invest in building strong supply chains to achieve business success.

65. The Adoption Rate of AI in the Supply Chain is Projected to Grow by 45.55% by 2025

The adoption rate of artificial intelligence (AI) in the supply chain is projected to grow by 45.55% by 2025 according to Statista. This growth is expected to occur in companies operating in supply chains and manufacturing industries worldwide. The adoption of AI in the supply chain can drive significant value, with the grocery sector alone expected to see an additional $113 billion in value by 2025. The growth in this market is mainly driven by factors such as growing big data, demand for greater visibility and transparency into supply chain data and processes, and adoption of AI for improving consumer services and satisfaction.

AI can provide detailed region-specific demand to help business leaders make better decisions, and AI-powered forecasting tools can help customize fulfillment processes according to region-specific requirements. The artificial intelligence in the supply chain market is expected to reach USD 10,110.2 million by 2025 from USD 527.5 million in 2017, at a CAGR of 45.55% during the forecast period.

66. Industrial Suppliers Have an Average Supply Chain Cost of 13.2%, While the Best Companies Have Managed to Optimize This Number to 7.9%, resulting in 40% Savings

According to Zippia, the average supply chain cost for industrial suppliers is 13.2%. However, the best companies have managed to optimize this number to 7.9%, resulting in a 40% savings. This highlights the importance of optimizing supply chains, as reducing supply chain costs can save time and money, as well as reduce disruptions and delays.

67. 57% of Companies Believe That Supply Chain Management Gives Them a Competitive Edge

According to Medium, 57% of companies believe that supply chain management gives them a competitive edge. This is because a strong supply chain enables companies to meet customer expectations, reduce costs, and increase profits. Additionally, it helps businesses optimize their operations and improve their overall performance. Supply chain management involves the integration of a variety of activities and processes, including procurement, production, distribution, and customer service.

Companies that are able to manage their supply chains effectively are able to gain a competitive advantage over their competitors. By reducing costs and increasing efficiency, companies can maximize their profits and increase their customer satisfaction.

With the advent of digital technology and the internet, the scope of supply chain management has expanded greatly, and companies are increasingly leveraging technology to improve their supply chain efficiency and gain a competitive edge.

68. The Average Supply Chain Cost Reduction from 9% to 4% Has the Potential to Double a Company’s Profits

Reducing supply chain costs is a crucial aspect of any business, as it can lead to significant increases in profits. According to Zippia, reducing supply chain costs from 9% to 4% has the potential to double a company’s profits. This is because supply chain costs often represent a considerable percentage of the sales price of a good or service, and cost savings flow directly to the bottom line. However, it is important to note that cost reductions and their impacts must always be assessed for the supply chain as a whole, as careless cuts for one part can end up increasing costs elsewhere.

Effective supply chain cost reduction relies on a macro as well as a micro approach, and mental flexibility too. The field for potential reductions is wide open, and there are many aspects that can be considered for cost savings. Cutting costs throughout supply chain activities can lead to a significant increase in profits. Poor supplier relations can lead to significant disruptions and cost increases that cut into profitability. Therefore, companies are evaluating their full value chains, looking for ways to reduce costs in a sustainable manner

69. Global AI in Supply Chain Market Expected to Reach $41.23 Billion by 2030

The global AI in the supply chain market is expected to grow significantly in the coming years, with a projected worth of $41.23 billion by 2030 according to Research and Markets. The market is expected to grow at a CAGR of 38.8% during the forecast period of 2023-2030. The growth of the market is being driven by the increasing demand for enhanced visibility and transparency in the supply chain. AI technology is being used to optimize supply chain operations, reduce costs, and improve efficiency. The market is segmented by offering, including hardware (processors, storage, and networking), software, and services.

The use of AI in supply chain management is expected to increase significantly in the coming years, as companies look for ways to improve their operations and gain a competitive edge. The growth of the market is also being driven by the increasing use of automation and robotics in the supply chain. AI-powered robots are being used to perform a variety of tasks, including picking and packing, sorting, and transportation. The use of AI in the supply chain is expected to revolutionize the way goods are produced, transported, and delivered, leading to greater efficiency and cost savings.

70. AI-enabled Supply Chain Management Reduces Logistics Costs by 15%, Inventory Levels by 20%, and Service Levels by 40%

AI-enabled supply chain management has been a game changer for organizations, providing them with the ability to automate their operations, improve performance, reduce costs, and manage risks more effectively. Inbound Logistics shows that effectively deploying AI-enabled supply-chain management has helped organizations reduce logistics costs by around 15%, inventory levels by 20%, and service levels by 40%.

AI’s ability to analyze huge volumes of data, understand relationships, provide visibility into operations, and support better decision-making makes AI a potent instrument to help organizations tackle supply chain challenges. AI forecasting can reduce warehousing costs by 5% to 10% and lower administrative costs by 25% to 40%. Supply chain management solutions based on AI are expected to address the opportunities and constraints of all business functions, from procurement to sales.

Retailers and manufacturers that incorporate AI in supply chain management greatly enhance their ability to forecast demand, manage inventory, and optimize prices. The integration of AI in logistics can be observed across various aspects of the supply chain, with several key applications gaining prominence. By breaking down barriers and incorporating advanced data analytics, AI has revealed insights previously unattainable, enabling managers to be proactive and reduce unexpected disruptions.

Supply Chain Statistics – What the Numbers Actually Mean

Despite the COVID 19 pandemic still rearing its ugly head from time to time, procurement remains strong and the supply chain industry is benefited from it as a result. This can be seen with how many procurement teams still getting hired and paid to do the sourcing of needed supplies for companies that need them.

Therefore, one can safely say that supply chain statistics will remain positive all throughout the year. Some of the most recent statistics reveal just how the supply chain is keeping up, despite the economic crunch:

Automation and AI

As noted with Dexterity, companies that provide AI and automation solutions for supply chain management are only going to continue to grow. In addition to the warehouse solutions provided by Dexterity, automation can be deployed for supplier management and AI can actively detect and respond to changes in demand as they occur.

Automation and AI can increase end-to-end visibility and transparency of an entire supply chain, which allows companies to better mitigate potential disruptions, improving supply chain performance. The increase in efficiency provided by increased automation is likely to be a key driver in revenue growth. This will occur alongside and help accelerate their human comrades being able to focus on more cognitively demanding tasks.

Security Risks

Supply chains are highly susceptible to security risks because there are so many elements that go into securing a supply chain. For example, securing a supply chain involves coordinating physical and cyber security. Within cybersecurity, there are a variety of risks including ransomware attacks and data breaches. It is not surprising then that security is one of the biggest challenges faced by global supply chains.

As cyber-attacks on supply chains continue to rise, expect security to remain a hot topic as it pertains to the supply chain. Products that offer defense against these attacks are likely to see high adoption rates as organizations begin to prioritize supply chain security.

Visibility and Transparency

Visibility into all parts of the supply chain is vital. Supply chains are continuing to digitize, and as this occurs, it is easier for organizations to seek insights related to visibility and transparency in all aspects of their supply chains.

More visibility makes it easier to avoid minor problems, such as delivery delays or order errors, which improves customer service. This transparency also improves the time to resolution for larger issues as they arise.

Procurement Expert’s Advice on Supply Chain Statistics

For this article, we asked an experienced procurement expert to share her insights to help answer common questions about supply chain statistics.

Nesrin Chabbah

Senior Lead Buyer

LinkedIn Profile: linkedin.com/in/nesrin-chabbeh

1. What do most people get wrong about supply chain statistics?

“Most people tend to underestimate the transformative potential and urgency of embracing advanced technologies and sustainability within the current supply chain landscape. The 70 key supply chain statistics for 2023 emphasize the importance of AI, sustainable practices, and digitalization, yet many might overlook the significant impact these elements can have on improving efficiency, reducing costs, and ultimately driving profits. The extent to which AI can optimize operations, reduce logistics costs, and enhance visibility is often underestimated. Additionally, the long recovery period for supply chains and the need for a proactive approach to address disruptions are aspects that are sometimes not fully grasped. Overall, the key misunderstanding lies in undervaluing the role of technology and sustainability in shaping the modern supply chain landscape.”

2. What should people know about the supply chain statistics if they are planning to start working on this?

“For those venturing into supply chain management, understanding the entire process is key. Technology integration, especially AI and data analytics, is crucial for efficiency and informed decisions. Building resilient and flexible supply chains to adapt to disruptions is a priority, alongside sustainable practices and a customer-centric approach. Risk management, collaboration, and continuous improvement are vital strategies. Being aware of regulatory compliance, staying informed through educational resources, and honing negotiation and communication skills are also crucial. Balancing operational efficiency, global dynamics, financial acumen, and ethical considerations completes a well-rounded approach to supply chain management.”

3. From your experience, what is the most important thing you learned about supply chain statistics?

“Supply chains are intricate, involving numerous variables that can change rapidly, necessitating agile responses. From technology integration to risk mitigation and sustainability, flexibility and preparedness for unexpected disruptions are vital. Additionally, understanding the vital role of data and analytics in making informed decisions and optimizing operations is paramount. Ultimately, supply chain success hinges on a harmonious blend of strategic foresight, operational efficiency, and resilience.”

4. What tips can you give them to be effective in the supply chain?