Written by Marijn Overvest | Reviewed by Sjoerd Goedhart | Fact Checked by Ruud Emonds | Our editorial policy

Three-Way Matching — Definition, Example, and Best Practices

What is three-way matching?

- A three-way matching is the process of comparing the purchase order (PO), the goods receipt note (GRN), and the invoice to ensure they align before making a payment.

- Besides safeguarding against unauthorized expenditures, the three-way match process fosters trust and transparency in vendor relationships.

- A manual three-way matching process can be time-consuming and labor-intensive. Automating the process can significantly enhance efficiency.

What is Three–Way Matching?

Three-way matching is the process of comparing the purchase order (PO), the goods receipt note (GRN), and the invoice to ensure they align before making a payment.

Three-way matching is an important control process in accounts payable (AP) that ensures the payment made is only for valid transactions carried out, thereby guarding against fraud of invoices and unauthorized expenditures.

It begins when a buyer places an order, formalized through a PO that specifies the items, quantities, and agreed prices. Once the supplier ships the goods, they send an invoice detailing the delivered items and the total cost based on the PO.

Upon delivery, the receiving team checks the quantity and quality of the goods and issues a receipt note. The accounts payable team then cross-checks the PO, invoice, and receipt note to confirm that all details align—ensuring the correct items were ordered, received, and billed.

If everything matches, the invoice is approved for payment, guaranteeing accuracy and preventing discrepancies.

Three-way matching is a secure but time-consuming process, involving coordination between the buyer and supplier to verify documents. Still, it is a powerful strategy, particularly for audits, to confirm order receipts and invoices are correct, simplifying tax reporting.

Automating this process can save time, reduce costs, improve accuracy, and strengthen relationships with suppliers. It also speeds up payments, makes audits easier, and helps catch mistakes or fraud.

For these reasons, it’s a good idea to use three-way matching whenever possible, with automation when you can, to improve efficiency and keep better control of finances.

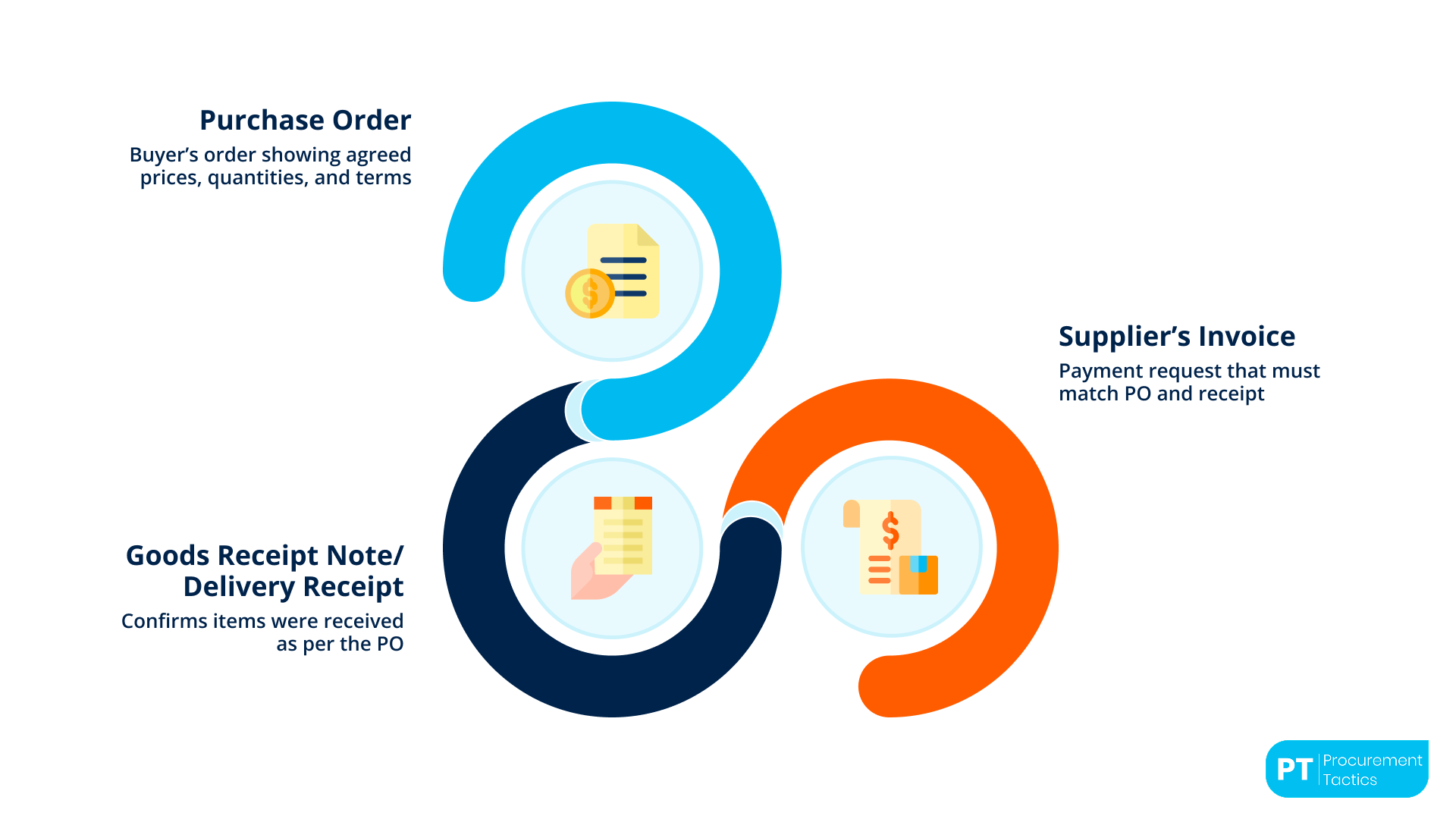

The Components of a Three-Way Matching

1. Purchase Order (PO)

This is the official document released by the buyer at the time he is contracting himself to pay the seller, who is supplying him with some products or services at agreed prices.

It reflects details through which the three-way matching process shall be executed, indicating the quantity and cost of items that were ordered.

3. Supplier’s Invoice

An invoice issued by the supplier requesting to make payment against goods or service delivery. It should match the details outlined in both the PO and the delivery receipt to warrant payment.

Real-Life Example of Three-Way Matching

A good example of a real company where three-way matching had been implemented is the multinational conglomerate Siemens AG.

Siemens AG has always taken care to place efficient and transparent financial processes at the center of its operations, protected from errors and fraud by engineering excellence and a tradition of innovations.

Siemens has embedded a three-way matching system in the enterprise resource planning (ERP) software to further streamline the company’s procurement and financial processes.

The system allows matching purchase orders, received goods, and supplier invoices to be done automatically before payments are made, ensuring that payments are for goods and services ordered and received properly.

At Siemens, this system has resulted in a more effective accounts payable procedure, such that the manual checking and matching of these documents have been cut down both in terms of time and manpower.

It also minimizes the risks associated with overpayment or payment for goods not delivered, hence strengthening financial control with minimized prospects of fraud.

Case Study: Google and Facebook Three-Way Matching

A Lithuanian man has made headlines for defrauding tech giants Google and Facebook of $123 million through business email compromise (BEC), raising awareness about the vulnerabilities of modern-day transactions.

This example highlights a simple yet devastatingly effective job in the world of cyber fraud: invoice fraud. The accused posed as genuine business partners of some of these corporates and succeeded in extracting huge sums transferred to offshore accounts, as payment for services that were never rendered.

The fact that they have both managed to recoup the stolen funds is somewhat of an outlier in the grim landscape of BEC scams. Usually, in such cases, the victims—ranging from individuals to huge corporations—rarely see a penny of their money. The BEC scam, therefore, is a huge gap in the cybersecurity defense line of even those companies that are technically most developed. Incidents like these reiterate the implementation of strict financial control processes to minimize any fraud.

This incident with Google and Facebook magnifies the importance of the PO 3-Way Match system. With this architecture in place, the system not only has value in terms of preventing over-payments and fraud but also in building trust and transparency in relations with vendors through very careful planning.

This way, the adoption of such a system significantly reduces exposure to financial losses from fraud—a matter that remains, more or less, a pervasive concern for companies, from burgeoning startups to global behemoths.

Furthermore, its relevancy is further accentuated in the realms of digital transformation and automation as it delves into the PO 3-Way Match system.

Automation of this process would mean improved efficiency and accuracy of operations; it would also provide for a strengthened financial control environment that would cope with modern sophisticated cyber threats. Therefore, the harrowing experience of Google and Facebook is sufficient evidence that PO 3-Way Match is indispensable.

It reflects that implementing strict control over financial transactions is not operational but rather, the measure is a strategic need within an environment characterized by progressively complex cyber threats.

Best Practices of Three-Way Matching

1. Encourage Cross-Functional Collaboration

This means that the effectiveness of the three-way matching requires involving proactivity input with other departments and not only the AP department.

Open and continuous communication to be enhanced among the procurement, receiving, and accounting teams.

Systematic meetings will involve resolving recurring problems, sharing ideas, and updating between changes and expectations, which can help in reducing discrepancies in an early stage.

This collaborative approach ensures a united understanding of the process, roles, and responsibilities, and therefore, allows smooth workflow.

2. Implement Routine Audits

The three-way matching process is crucial to ensuring integrity and efficiency and hence requires regular and random audits.

The essence of these audits should capture the random checks of both the matched and unmatched invoices, verification of document authorization, and timely discrepancies resolution.

All of those contribute to the overall effectiveness of the process and further uplift it with the aid of such audits, where organizations may spot and polish bottlenecks, inaccuracies, and areas that need improvement.

3. Prioritize Training and Development

However, with the current dynamic business practices, regulatory environments, and advances in technology, training and development on an ongoing basis are essential for the three-way matching to be effective.

Constant education investment of procurement and accounting professionals ensures the organization remains current with technologies and practices.

Seeing training as an investment and not as an expense is likely to fortify better financial health and the tendency to operational success.

4. Adjust Matching Criteria for Efficiency

Scope down three-way matching in the system only for large and non-recurring invoices to be more efficient.

Smaller recurring invoices need not be put under such rigorous scrutiny, setup, alternative methods can be set up to reduce exposure to fraud in transactions of high volume and low value.

This is a big difference: focusing the efforts on areas of high importance, and this is where this targeted approach allows the AP team without compromising security.

5. Introduce Flexible Settlement Rules

Flexibility in the settlement of invoices should avoid unnecessary payment delays. This is done without compromising security—flexibility that would otherwise let the AP personnel rush for payments with insignificant discrepancies across invoices, purchase orders, and receiving reports.

This will optimize the pragmatic approach to streamline the process of suppliers’ payments in good time without degrading the operations.

Benefits and Challenges of Three-Way Matching

Practical Application of Three-Way Matching

Picture a manufacturing entity that requires raw materials for its production line. The raw material has to be ordered from a reliable supplier to safeguard quality and the required order-delivery time.

Step 1: Issuance of the Purchase Order

The procurement team decides to order 1,000 units of raw materials. They create a Purchase Order (PO) that includes:

- Material details

- Quantity: 1,000 units

- Unit price: $10 per unit

- Total cost: $10,000

- Delivery terms and payment conditions

This PO is sent to the supplier as a formal request.

Step 2: Receipt of Goods and GRN Creation

When the supplier delivers the materials, the receiving team checks the shipment against the delivery documents. They confirm that 1,000 units were delivered in good condition. They then create a Goods Receipt Note (GRN), which records:

- The quantity received

- The receipt date

- Any issues found

In this case, the GRN confirms the receipt of 1,000 units, exactly as ordered.

Step 3: Invoice Receipt and Verification

The supplier then sends an invoice, which includes:

- Order number

- Delivery date

- Quantity: 1,000 units

- Unit price: $10 per unit

- Total amount: $10,000

The accounts payable team compares the invoice with the PO and the GRN to ensure they match.

Verification Process:

- Purchase Order (PO): Ordered 1,000 units at $10 per unit ($10,000 total)

- Goods Receipt Note (GRN): Confirms receipt of 1,000 units in good condition

- Supplier Invoice: Bills for 1,000 units at $10 per unit ($10,000 total)

Step 4: Payment Authorization

Since all details match, the accounts payable team approves the invoice for payment. This process ensures the company only pays for the goods it orders and receives, preventing overcharges or fraud.

2-Way vs 3-Way vs 4-Way Matching

While the standard business practice involves three-way matching, this can alternatively be a two-way match—for only the PO and the supplier’s invoice. This leaves room for faster processing, however at an increased risk for the discrepancies around delivery.

On the other hand, the detailed approach—four-way matching—will add an extra layer of quality check when goods of high value or a critical item are received, although at the expense of increased processing time and paperwork.

Handling Discrepancies in a Three-Way Match

In cases where discrepancies such as quantities, descriptions of items, or costs occur during the matching process, AP clerks have to make a manual investigation and do a resolution of every receiving department record, supplier document, and purchase order document.

Such discrepancies should never be resolved at such a time as payments can be placed on hold to assure the financial integrity of the firm.

Three-way matching may seem like a lot of time, but it is an indispensable process, most importantly for high volumes of purchasing companies.

Highly important in overseeing financials, preventing fraud, and overall expenditure control, the payment made is supposed to be for goods and services received as agreed.

Conclusion

The 3-Way Match System of PO is an important financial control and procurement efficiency tool for businesses. Not only does it shield from overpayments and fraud but also facilitates optimized cash flow management as well as enhances the accuracy of financial reporting.

With more and more areas of the world adopting digitization and automation, having an automated three-way matching system is beneficial for businesses in terms of increased efficiency and reduced errors, allowing processes to be smoother than ever before.

But to gain fully from these benefits, the system has to be implemented carefully with frequent audits and continuous improvement.

To achieve this, organizations have to implement best practices, align functions, and leverage technology to cope with the complexity of the process.

In the end, the PO 3-Way Match is not just a process—it’s a competitive edge. By keeping payments strictly aligned with goods and services that are confirmed, delivered, and accepted, companies can safeguard their bottom line, deepen supplier relationships, and cut through the intricacies of procurement.

Frequentlyasked questions

What is three-way matching?

Three-way matching is the process followed under accounts payable to verify that any incoming invoice from a supplier is for a valid and correct amount before making payments. It is based on cross-referencing three documents: a purchase order (PO), a goods receipt note (or delivery receipt), and the supplier’s invoice.

How does the three-way matching process work?

The process begins with the issuance of a purchase order by the buyer to the supplier. The buyer shall raise an invoice to the supplier, who, upon getting the goods or services, shall do an invoice verification with both the purchase order and goods receipt note.

The match should confirm that the quantity, description, and prices exactly match those on the invoice and that terms agreed upon are being met while receiving the goods or services.

If all details match across these documents, the invoice is approved for payment.

What are the benefits of implementing a three-way matching process?

The process of a three-way match has several benefits for the business. It would minimize the possibility of false invoices and financial loss by only ensuring that validated transactions are being paid. This helps in keeping clean and accurate financial records, really well, which sometimes might assist in audits.

About the author

My name is Marijn Overvest, I’m the founder of Procurement Tactics. I have a deep passion for procurement, and I’ve upskilled over 200 procurement teams from all over the world. When I’m not working, I love running and cycling.